Nevada's Best Mortgage Lenders & Current Mortgage Rates

Student loan refinance rates plunge to near-record lows - Fox Business

Current Reverse Mortgage Rates: Today's Rates, APR - ARLO™

The Nevada's Best Mortgage Lenders & Current Mortgage Rates Ideas

Continue reading for more details on each reason to re-finance. Cash-out refinance Your month-to-month payments steadily decrease the quantity you owe on your home mortgage. And, unless you're unfortunate adequate to live someplace with flat or falling home costs, increasing residential or commercial property worths will help increase your "equity." That's the amount by which your home's market price surpasses your mortgage balance.

However, know that a lot of lending institutions like the total loaning protected on your home (your brand-new, refinanced home loan plus any home equity loans or home equity credit lines (HELOCs)) not to exceed 80% of your house's appraised worth. You can hunt around for a more generous lending institution. However know that only VA loans normally allow you to access all your equity.

10 Best Nevada Mortgage Lenders of 2021 - NerdWallet

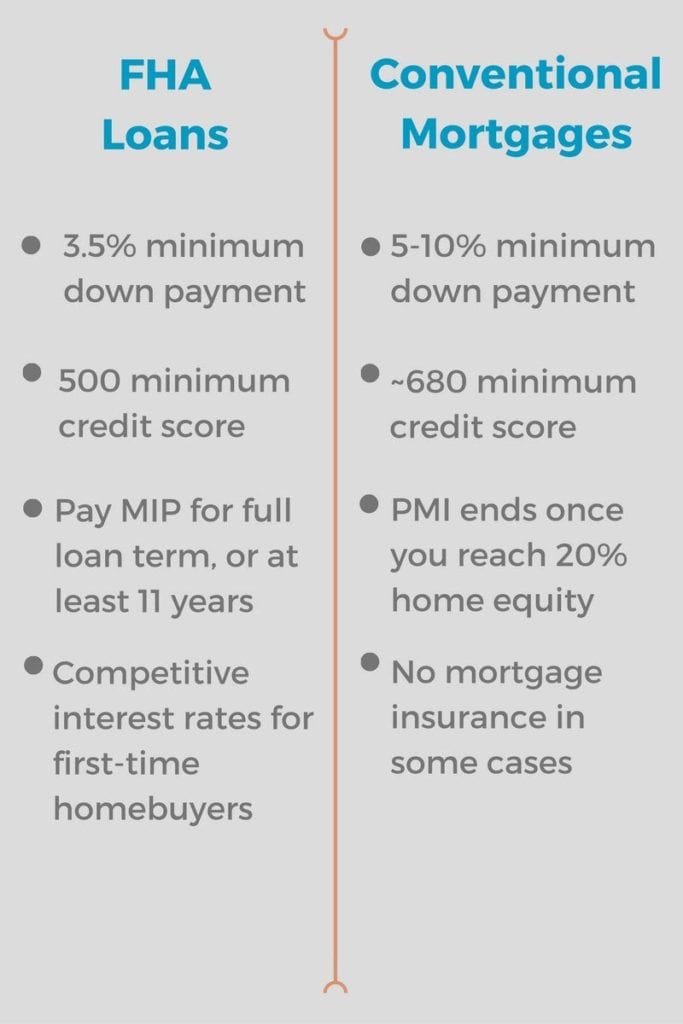

A lower home mortgage rate is usually a good idea, supplying the decrease suffices to easily cover your refinancing costs. Some kinds of home loan (VA, FHA, USDA) let you undertake a "enhance" re-finance. One of those cuts down significantly on paperwork and costs. And you might not even need a credit check or appraisal.

5 Easy Facts About The Nation's #1 Wholesale Mortgage Lender - UWM Shown

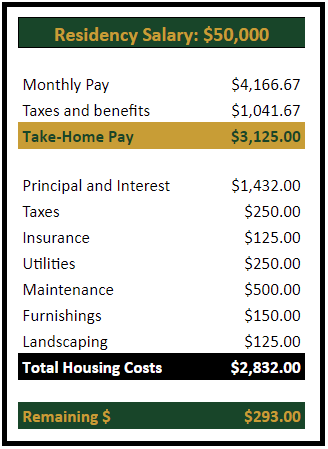

Lower monthly payment Yes, there is a downside to having a lower regular monthly payment and mortgage rate. And that's that you're resetting the clock on your home mortgage. Imagine Click Here For Additional Info have actually had a 30-year home mortgage for a decade. And suppose you now re-finance to a new 30-year home mortgage. You'll be spreading your borrowing expense over 40 years instead of 30 years.

With a new 30-year loan, you won't be mortgage-free up until 2050. Worse, you'll be paying interest over those four decades, which is far more pricey than borrowing over three. If you have an FHA loan, you have actually another factor to consider. Providing you leave a minimum of 80% of your equity in your house, switching to a various kind of home loan need to see you removing your month-to-month home mortgage insurance premiums.

Obviously, if you're desperate to minimize your monthly outgoings, you most likely won't care. But, if you're not, it's something to bear in mind. Naturally, if money's easy, you could constantly Reduce the life expectancy of your mortgage Simply as extending the life of your home mortgage (resetting the clock on it) brings lower monthly payments, lowering that life brings higher ones.